Apps and services like MoneyLion let you borrow money immediately before your next paycheck. However, these solutions may appeal to some; therefore, many individuals look for alternatives.

MoneyLion is a personal finance and lending mobile app that helps customers gain financial control by giving tools to manage their spending, saving, and credit usage.

The organization was founded in 2013 by a group of scientists and bankers in New York City. They have gathered a user base of over 2 million customers, but they also offer MoneyLion Plus. It provides a service that enables you to get low-interest loans without checking your credit. Through MoneyLion Plus, they have originated over 200,000 loans.

What is MoneyLion?

MoneyLion is a finance powerhouse powered by technology that provides unique financial solutions to individuals like you. It can make creating and achieving financial goals as simple as possible, whether you’re an experienced digital financial guru or just want to simplify your financial accounts.

MoneyLion is a cutting-edge platform that offers a one-stop shop for digital financial services. Unlike other platforms that may seem similar from a distance, MoneyLion focuses on accessible and effective solutions for everyone looking to improve their financial situation. It is a comprehensive financial center and cutting-edge mobile app simplify overcoming financial obstacles such as developing credit or opening an investment account.

Website: https://www.moneylion.com

Is MoneyLion Legit?

Their website and application procedure are simple and transparent, they give competitive interest rates, and they provide high-quality and dependable customer service. MoneyLion is a fantastic alternative for anyone needing a loan or other financial services. MoneyLion and MoneyLion Plus are mobile banking finance apps that are legal to use.

What Services are Provided by MoneyLion?

1. Mobile Banking

- RoarMoney is an FDIC-insured, free checking account with various appealing features.

- Set up automatic direct payments to get your paychecks up to two days early.

- It is an almost fee-free account with no required minimum balance.

- When you bank with RoarMoney, you may get cash back when you use your debit card at member companies.

- Price Match – if you find anything you bought at a lesser price, you may have the difference paid back.

- With your RoarMoney account, you can track your spending and set your budget.

2. Instacash

- Get no-interest cash advances of up to $250 from the ease of your MoneyLion app.

- Apply for Instacash by connecting an eligible checking account – your account must be at least 2 months old, have a history of frequent deposits, have a positive balance, and be visibly active to qualify. You must also prove your identity and account ownership.

- To request a cash advance, just touch Request on your app and enter the desired amount and transfer date.

3. Credit Builder Plus

- Credit Builder Plus, a hybrid savings-credit-building account, offers a reliable path to credit development. It is a monthly membership service that provides access to minor credit-building loans. You will not be asked for a credit check when applying for one of these loans.

- Credit Builder Plus loans are 12-month installment plan loans meant to improve your credit score by establishing a consistent payment history.

- You’ll also receive credit monitoring, which includes weekly updates on crucial credit indicators, including payment history and card use.

- You may acquire Instacash up to $50 at 0% APR using your RoarMoney account or the MoneyLion app.

- When the loan is fully returned, you will have the whole amount in your savings, which you may then access and spend whenever you like.

4. Automated Investing

- MoneyLion lets you invest with no maintenance fees and no minimum balance.

- Risk Slider authorizes you to create a portfolio depending on your risk tolerance and investing time horizon.

- Take advantage of a customized, customizable portfolio design.

- There is a fully automatic investment and dynamic rebalancing available.

- Thematic Investing: Focus your asset allocation on your investment goals, such as socially responsible investing.

- Auto invest: Contribute to your investment account regularly with scheduled, automated payments from your connected bank accounts.

- You may change your allocation as often as every five days, making it ideal for long-term investing.

5. MoneyLion Cryptocurrency

- Zero Hash-powered, but not accessible in New York or Hawaii.

- Invest in Bitcoin with cryptocurrency round-ups.

- 24/7 buy, sell, and hold crypto

- Control Bitcoin and Ethereum

- To discover more, use the hashtag #cryptocurious.

Who is a MoneyLion loan suitable for?

It does not do a complicated credit investigation when registering for its Plus membership, so it might be a good alternative if you’re working on your credit or having difficulties getting a loan approved. However, you should not rely on this credit-building loan to cover an emergency. It’s a small amount, and part of it may be held in a reserve account until the loan is paid off.

On-time payments on the MoneyLion credit-builder loan might help you build a good payment history. Consider paying off the loan early to reduce interest charges and save money.

The company might be a suitable match if you want to build credit and are interested in MoneyLion’s other services.

How to Sign Up for a MoneyLion Account

Anyone may apply for a MoneyLion account. When you sign up MoneyLion Core, you get a RoarMoney Fee-Free Checking account and a MoneyLion Managed Investment account.

Once registered, you may apply for a Credit Builder Plus account, which allows you to apply for modest credit builder loans of up to $1,000. After you’ve paid off the loan, you will have full rights to the savings in your Credit Builder Plus account.

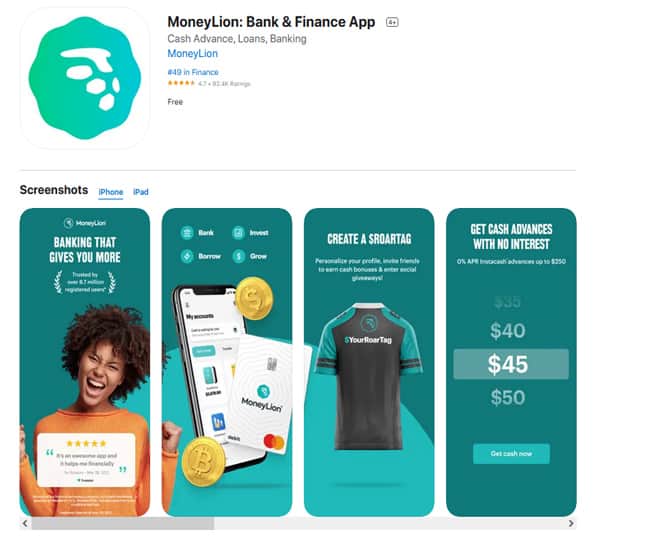

Sign up on the MoneyLion website or by downloading the app, which is available in the Apple App Store and Google Play.

MoneyLion App For Android and iOS

MoneyLion is not a bank but rather a financial technology startup. RoarMoney demand deposit account offered by Pathward, National Association, Member FDIC, and MoneyLion Debit Mastercard® issued by Pathward, National Association. It owns the service mark RoarMoney. Mastercard and its designated circles are registered trademarks of Mastercard International Incorporated. When we receive funds put into your account, they are FDIC-insured, subject to any relevant limits and restrictions.

Using direct deposit. Electronic Direct Deposit provides faster access to money than a traditional check.

MoneyLion offers the 0% APR cash advance service 2 Instacash. Your available Instacash advance limit is shown in the MoneyLion mobile app and is subject to change. It will establish your credit limit based on your direct deposits, account transaction history, and other variables. This service is free of charge. Optional gratuities and Turbo Fees are available for quicker money delivery.

For example, your payback amount for a $40 Instacash advance with a $4.99 Turbo Fee will be $44.99. Generally, your payback date will be the date of your next direct deposit, which might be weekly or monthly, depending on your deposit cycle. An Instacash advance is a non-recourse product, not a personal loan, and there is no necessary minimum or maximum timeline for repayment; nevertheless, you will not be eligible for a new advance until your current sum is paid in full. Additional terms, limitations, and eligibility restrictions are detailed in the Membership Agreement and at http://help.moneylion.com.

You can download MoneyLion App from Google Play and App store, Alternately you may scan the QR code from the official site to download the app on your device.

How to apply with MoneyLion?

MoneyLion credit-builder loan applications may be submitted by PC or mobile app. The first step is to open an account with MoneyLion. To open an account, you must provide your complete name and address.

Following this, you may apply for a Credit Builder Plus membership and request a credit-builder loan. Here’s everything you’ll need to do the job.

- Full name

- Valid email address

- Number of Social Security

- Home address

- Verifiable phone number

- A bank account that can be verified and is in good standing.

Why should you choose MoneyLion Services?

You may establish an account and apply for a Credit Builder Plus membership via MoneyLion’s mobile app. However, before enrolling for a membership, here are a few things you should know about the credit-builder loan.

There is no prepayment fine if you pay off your MoneyLion credit building loan early; there is no early payback penalty cost.

Deferment support is provided – If you need to postpone payment for whatever reason, MoneyLion may enable you to do so if you submit a deferment application.

MoneyLion provides free credit monitoring, which TransUnion powers. You will get a complete credit report, which you may analyze for any possible inaccuracies or fraudulent activities.

Extra membership benefits – Your account includes a no-fee MoneyLion checking account that allows you to earn cash back when you purchase from sponsor companies.

Benefits of MoneyLion Plus

MoneyLion Plus is a membership service for MoneyLion app users with various fantastic features. For example, they examine your spending patterns to determine when to withdraw funds from your checking account. They also provide specific daily budgeting recommendations to help you spend less money.

The MoneyLion Plus account also includes a managed investing account. They automatically invests your savings into a broad portfolio of ETFs tailored to each member’s financial requirements and life stages. This program has no maintenance costs, and if you join up via LendEDU, MoneyLion will put $10 into your investing account.

MoneyLion also provides access to low-interest loans. They approves you for a low-interest loan based on behavioral data and analytics from your usage of the MoneyLion app. You may borrow up to $500 with interest rates as low as 5.99%. The most significant advantage is that you do not require a credit check to get accepted.

They also provide a bonus of $1 cash back when users connect to the MoneyLion app. In addition, you may also receive cash incentives depending on the balance of your investing account.

Ultimately, the idea is to assist consumers in accumulating money and weathering unforeseen bills. The standard app works with these specialized services to provide a unified saving, borrowing, and investing approach.

Drawbacks of MoneyLion Plus

Your unique financial and credit position determines MoneyLion Plus’s suitability. MoneyLion Plus deducts $79 from your account each month. They then transfer $50 into your investment account, and the remaining $29 is your monthly charge. That’s a little pricey, but you can cut it down. In addition, you earn $1 cash back every time you connect to the app. However, for MoneyLion Plus to be free, you must remember to check the app every day.

The $29 membership fee is worth it, depending on how much you’ve invested with them and how much you’re borrowing. After all, if you only have $290 in your account vs. $29,000, $29 represents a significant chunk of your investment. If you never logged in, the total cost for the year would be $348. While you are unlikely to spend that much, you may be better off joining up with another investing provider that gives a higher rate.

Also, the credit they provide you without a credit check seems to be a good bargain until you discover that you may only borrow $500. Then, you’re out of luck if you need more. However, if you have strong credit, many alternative firms provide personal loans at cheaper or comparable rates, such as Citizen’s Bank. These lenders will also allow you to borrow more money.

The disadvantage is that you will have to pass a credit check to qualify for such loans. As a result, if you have low credit and need a little quantity of cash in an emergency or to improve your credit, MoneyLion Plus might be a perfect solution.

How can I contact MoneyLion Customer Service?

They are pleased to help you if you need assistance. If you can’t find a way to solve your issue in the FAQs, you may get help in the following ways:

1. MoneyLion Chatbot

Resolve your issue with the chatbot or a live conversation with an agent! It is the most excellent approach to getting help!

Within the MoneyLion app, you can enter the chat by clicking on the dialogue bubble in the top right-hand corner or your computer’s bottom right of the MoneyLion online dashboard.

2. MoneyLion Support Phone Number

If you need to contact us using a Phone number, please dial 1-801-252-4427. [For the quickest answer at this time, they strongly advise using the chatbot.]

Apps Like MoneyLion

There are various smartphone apps similar to MoneyLion available on the market. However, It’s up to you which app suits your requirements as you cannot use all of them; some are better than others.

1. Earnin – https://www.earnin.com

2. Branch – https://branch.co

3. Dave – https://dave.com

4. PockBox – https://pockbox.com

5. CashNetUSA – https://www.cashnetusa.com

6. Even – https://www.even.com

7. Chime – https://www.chime.com

8. Avant – https://www.avant.com

9. Varo – https://www.varomoney.com

10. PayActiv – https://www.payactiv.com

11. Digit – https://digit.co

12. Empower – https://empower.me/banking

13. Stash – https://www.stash.com

14. SoLo Funds – https://www.solofunds.com

15. LendUp – https://www.lendup.com

FAQ

1. How To Delete Your MoneyLion Account?

If you no longer want to maintain an active MoneyLion account, the company has made it simple to discontinue your membership and close your account.

Follow the steps below to deactivate your MoneyLion account. Remember that any outstanding loan amounts must be paid in full before closing your account.

- Log In And Visit Your Profile

- Select ‘Membership‘ followed by ‘Manage My Membership.’

- Tap On ‘Cancel‘

Request Deletion Through MoneyLion Support

You may also request for deactivation of your account by contacting MoneyLion support.

- Click here to use MoneyLion’s the customer care email form.

- Click “Send us an email.” While they offers live chat and phone help, their email form is the most accessible alternative.

- Complete the form with all the needed information.

- Select “Get Help with My Account” under the box headed “How can we assist you today?“

- Create a short note requesting that your account be permanently deleted.

- Await a response from the business. Then, if more actions are necessary, MoneyLion should inform you.

2. Can MoneyLion be used with a cash App?

Yes, You can send money to your MoneyLion account or use an instant-transfer app such as Venmo, Cash App, Zelle, PayPal, or a similar platform.

3. How to remove a bank account from MoneyLion?

To delete a linked account from the Accounts tab, touch the three dots to the right of the Accounts tab screen. This will open the More Options menu. Then, choose “Manage linked accounts” and delete the accounts you want to remove.

4. How does MoneyLion work?

It is among the best financial services companies offering no-credit-check credit-building loans to its customers. MoneyLion provides credit-builder loans with low-interest rates, but membership fees increase the total cost of the loan.

Their website and application procedure are simple and quick, they give affordable interest rates, and they provide high-quality and reliable customer service. MoneyLion is a perfect alternative for anyone looking for a loan or other financial services.

Final Words

MoneyLion Plus allows you to save, invest, and borrow all in one place, but their products aren’t suitable for everyone. They said when they initially launched their products and services, their mission was to assist customers who struggle to save their first $2,000 over two years.

As a result, MoneyLion Plus is likely better for individuals with lesser incomes, weak credit, difficulty getting low-interest loans, or difficulty saving money for one reason or another. The main disadvantage is that they demand a monthly fee for these services, which might eat into your funds if you don’t check the app regularly.